Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

Govt increases petroleum levy to placate IMF

ISLAMABAD: The federal government on Sunday increased the Petroleum Development Levy (PDL) to Rs 60 on petroleum products to fulfil...

To meet IMF demands, govt slaps 20pc FED on soft drinks

ISLAMABAD: To meet the demands of the International Monetary Fund (IMF), the government has decided to increase Federal Excise Duty...

National Assembly passes Finance Bill 2023-24

ISLAMABAD: The National Assembly on Sunday passed the Finance Bill 2023-2024, giving the go-ahead t the budgetary proposals for the...

IMF tells Pakistan to reset budget or lose loan deal

ISLAMABAD: With Pakistan meeting another International Monetary Fund (IMF) condition by removing all restrictions on imports, there are no end...

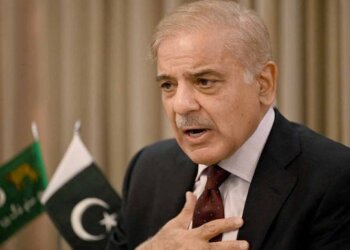

PM Shehbaz, IDB president exchange views on new avenues of collaboration

PARIS: Prime Minister Shehbaz Sharif and Islamic Development Bank (IDB) President Dr Muhammad Al Jasser on Friday took stock of...

Pakistan, Germany agree to enhance bilateral cooperation in diverse fields

PARIS: Pakistan and Germany agreed to enhance bilateral cooperation in multiple fields including trade, investment and energy. The bilateral ties...

ECC allows mills to export 32,000 tonnes of sugar

ISLAMABAD: The Economic Coordination Committee (ECC) has allowed the mills in Sindh to exports 32,000 tonnes of sugar till August...

Pakistan ‘keenly looks forward’ to IMF approval for 9th review

PARIS: After meeting the International Monetary Fund’s (IMF) managing director, Prime Minister Shehbaz Sharif said that Pakistan “keenly looks forward”...

FBR posts 41pc growth in income tax collection target ahead of year’s close

ISLAMABAD: Federal Board of Revenue (FBR) has surpassed the income tax annual target 10 days ahead of the close of...

Japan provides ¥315m for Human Resource Development Scholarship

ISLAMABAD: The Government of Japan announced grant aid worth 315 million Japanese Yen (around 2.25 million USD) for the Human...

Dar chairs CCoIGCT meeting

ISLAMABAD: Federal Minister for Finance and Revenue Senator Mohammad Ishaq Dar chaired a meeting of Cabinet Committee on Inter-Governmental Commercial...

PM Shehbaz, IMF MD discuss ongoing programme, bilateral cooperation

PARIS: Prime Minister Muhammad Shahbaz Sharif and Managing Director International Monetary Fund (IMF) Kristalina Georgieva met Thursday on the sidelines...

FBR holds three day international conference

ISLAMABAD: Federal Board of Revenue held three-day International Conference on Digitalization of Taxes in Pakistan at FBR Headquarters in collaboration...

540 billion invoices issued through POS in one year: FBR

ISLAMABAD: Federal Board of Revenue (FBR) has said that almost 540 billion invoices have been issued through the Point of...

ECC approves Rs1.9b technical supplementary grants

ISLAMABAD: In addition to approving various summaries, the Economic Coordination Committee (ECC) of the Cabinet approved Rs1,914.83 million in technical...

PRL to submit report on Russian oil in July

ISLAMABAD: In two weeks, the Pakistan Refinery Limited (PRL) is likely to submit to the government a report about the...

PM Shehbaz hopes to meet Kristalina Georgieva in Paris for rescuing IMF deal

ISLAMABAD: Can Pakistan still salvage the International Monetary Fund (IMF) loan programme? Well! There is still some hope as the...

PM for increasing FDI to $5b through SIFC

ISLAMABAD: Prime Minister Shehbaz Sharif has said with the help of the Special Investment Facilitation Council (SIFC), the immediate task...

Around 9000 retailers register under POS: FBR

ISLAMABAD: The Federal Board of Revenue (FBR) has said around 9000 retailers have registered under the FBR, Point of Sale...

OGRA takes swift action against violations in LPG industry

ISLAMABAD: In a proactive move to ensure compliance with safety standards and regulations in the Liquefied Petroleum Gas (LPG) industry,...