Latest News

News updates Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

IMF executive board likely to approve $1.1b funding for Pakistan on April 29

WASHINGTON: The executive board of the International Monetary Fund will meet on April 29 to discuss the approval of $1.1...

FBR arrests industrialist involved in sales tax fraud worth Rs1.63b

TOBA TEK SINGH: A Federal Board of Revenue (FBR) team has arrested one of the owners of Faisalabad’s Gold Star...

Peshawar RTO seizes illegal cigarettes worth Rs162.6m

PESHAWAR: The Regional Tax Office (RTO) Peshawar Inland Revenue Enforcement Network (IREN) team has seized 1,869 packerites of non-duty/non-TTS cigarettes,...

PCJCCI keen to boost Peach industry in Swat

LAHORE: Peach of Swat is one of the most famous fruit of Pakistan, the mango may be Pakistan’s preferred fruit...

IPO to celebrate World Intellectual Property day April 26

ISLAMABAD: The annual World Intellectual Property Day, observed on April 26, 2024, is set to focus on the theme “IP...

Karachi I&I detects artificial leather import scam worth Rs220m

KARACHI: Regional Directorate of Customs Intelligence (I&I) has detected fraudulent scheme involving the import of artificial leather worth Rs220 million....

Bill to curtail jurisdiction of commissioner IR appeals tabled in NA

ISLAMABAD: In a move to streamline the tax appeal process, the federal government has introduced a new bill in the...

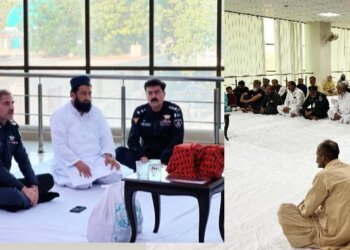

Quran Khawani held in honor of martyrs customs officials

MULTAN: Multan Customs officials held in honor of martyred customs officials. In a heartfelt tribute to the fallen heroes of...

KPT receives $50m upfront payment from AD Ports Group

KARACHI: Karachi Port Trust (KPT) has secured its first major revenue stream under a new concession agreement with Abu Dhabi...

FBR issues notices to 1,680 Tier-1 retailers to integrate with POS system

LAHORE: The Federal Board of Revenue (FBR) issued notice to 1,680 Tier-1 retailers to integrate into its Point of Sale...

SHC directs to release consignments imported by M/s Metallurgy International

KARACHI: Sindh High Court (SHC) customs appellate bench comprising Justice Muhammad Junaid Ghaffar and Justice Adan-ul-Karim Memon directed to release...

Afghan trade delegation, FPCCI discuss bilateral trade

LAHORE: Afghan trade delegation led by Board Member of Afghanistan Chamber of Commerce and Investment (ACCI) and Co-Chairman Pakistan-Afghanistan Joint...

WHO delegation calls on Chairman FBR

ISLAMABAD, Apr 23 (APP): A delegation of World Health Organization (WHO) comprising Roberto Iglesias, Consultant, and Santiago Carrillo expert on...

Aurangzeb reiterates govt’s resole to reduce poverty, promote development

ISLAMABAD: Minister for Finance and Revenue Muhammad Aurangzeb reiterated Pakistan’s commitment to engage with the United Nations Development Programme (UNDP)...

FinMin meets with BODs of Albaraka Bank, foreign shareholders to discuss economic outlook of country

ISLAMABAD: Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb met with the Board of Directors (BODs) of Albaraka Bank...

Aurangzeb meets with BMGF, Karandaaz to boost developmental collaboration

ISLAMABAD: Finance Minister Senator Muhammad Aurangzeb met with Syed Ali Mahmood, Country Lead for Pakistan at the Bill and Melinda...

Finance minister meets Chairman Anjuman-e-Tajran; discuss issues of business community

ISLAMABAD: Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb met with Chairman Supreme Council All Pakistan Anjuman-e-Tajran Naeem Mir...

PSX marks listing of Mahaana Islamic Index ETF

KARACHI: Pakistan Stock Exchange (PSX) held a gong ceremony to formally mark the listing of the Mahaana Islamic Index Exchange...

Terrorists involved in attacks on Customs officials killed in DI Khan operation: CTD

PESHAWAR: The Counter Terrorism Department (CTD) Tuesday claimed to have killed at least eight terrorists who were involved in attacks...

KCCI chief urges FBR to defer implementation of SRO 350

KARACHI: President Karachi Chamber of Commerce & Industry (KCCI) Iftikhar Ahmed Sheikh has asked the Federal Board of Revenue (FBR)...